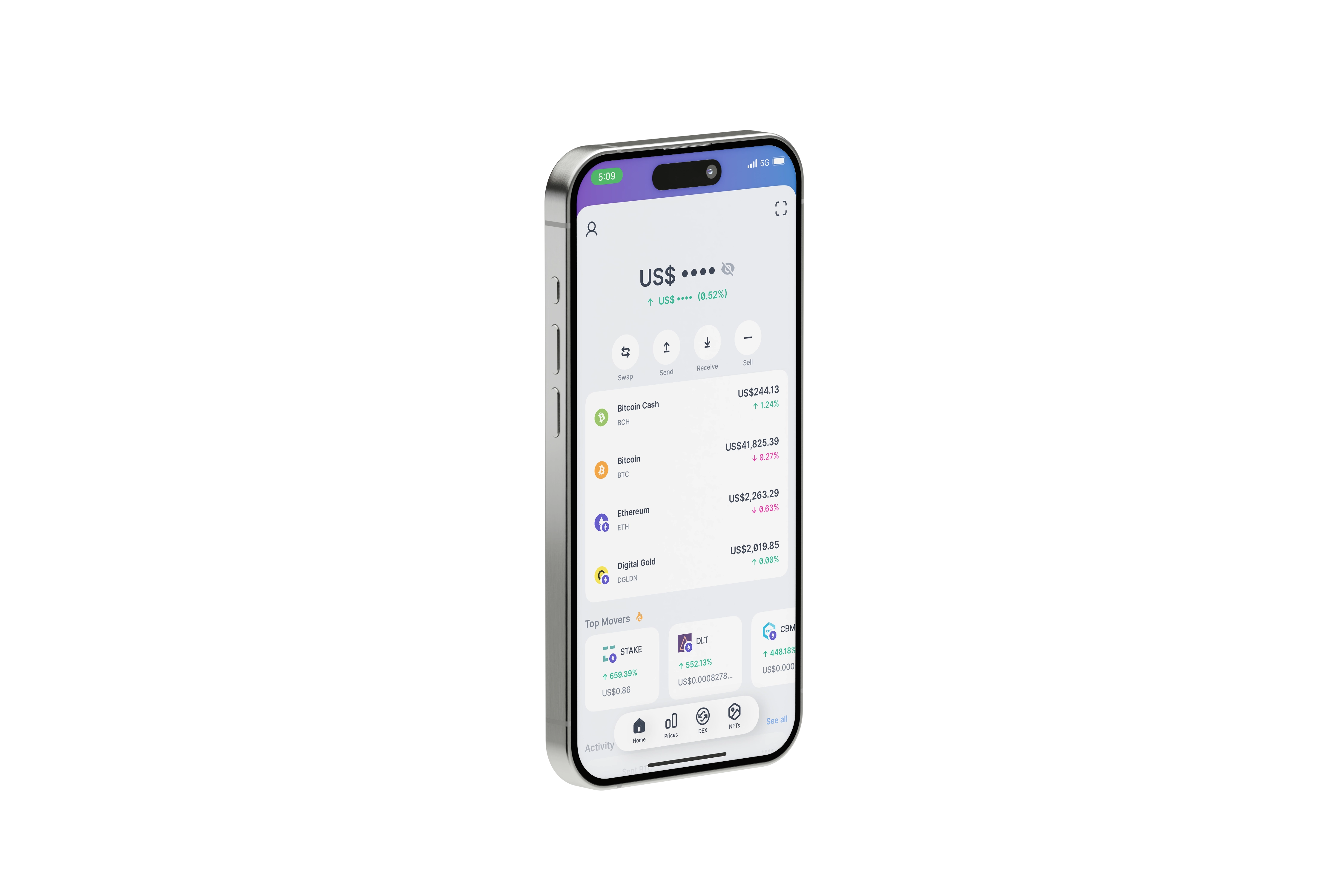

Seamless Digital Asset Banking

Open a Riviera account under your name*. It only takes a few minutes and provides you with instant access to top cryptocurrencies such as Bitcoin, Ethereum, Dai, Litecoin, XLM and many more, as well as next-generation features.

Trading

Expert trading on the cryptocurrency markets around-the-clock using Riviera’s vast liquidity, secure infrastructure, and knowledge.

Staking

By putting your cryptocurrency assets to work, staking helps certain cryptocurrency assets provide an eco-friendly dividend.

Custody

Riviera offers an institutional-grade digital asset custody solution that allows users to instantaneously access a vast array of digital assets from anywhere in the globe.

Lending

Obtain affordable financing options by pledging cryptocurrency or other valuables as collateral.

Faster Payments

Making payments with a Riviera debit card is simple. Link your cryptocurrency holdings to your needs for paying with fiat money.

Asset Management

Get access to a variety of investing options, both active and passive, to learn about the trends, growth, and potential for excess returns in the cryptocurrency market.

Payments are easy with Riviera

Payments are easy with a Riviera credit card. Connect your crypto assets to your fiat currency payment needs.

Learn moreFuture Finance blog

Read updates from our digital asset investment experts about the crypto market and new developments in blockchain technology.

All Articles

Bitcoin as a treasury reserve asset

Crypto

Over the past few years, Bitcoin has been steadily increasing its status as a safe haven asset for many investors, driven by ongoing macroeconomic traditional ....

Learn more

Driving on-chain capital markets

Tokenization

As the crypto sector becomes increasingly intertwined with traditional finance, the demand for reliable real-world data has grown exponentially.

Learn more

Seizing early opportunities

Tokenization

As the crypto sector becomes increasingly intertwined with traditional finance, the demand for reliable real-world data has grown exponentially.

Learn more

Bitcoin

BTC$69,468.53

Ethereum

ETH$3,692.22

Asset Management

Do more more with the expansion, trends, and chances for excess returns in the cryptocurrency market, access a variety of passive and active investment solutions.

Learn moreB2B Banking

Riviera makes access to digital assets easy with all-in-one, modular access that allows banks to focus on growing strong client relationships.

Learn moreTokenization

Explore novel investment prospects and generate funds for a range of asset classes, including private markets, artwork, and collectibles, using bank-grade tokenization.

Learn moreCrypto compliance and RegTech

Banks and VASPs can expand their crypto offering quickly, efficiently and in a compliant manner via Riviera's proven track-record in Crypto AML and RegTech.

Learn moreFuture Finance videos

We call the emergence of a trusted, secure and efficient digital asset economy Future Finance. Click on the video below to see an example, from a Riviera Bank event, of how we are making this a reality, built on our three pillars of trust, technology, together.

Watch more videosPatronised & Sponsored by Many

Organisations all over the world patronise us and provide us with substantial sponsorship to push us towards our set goals.

View all belowFAQ

We are convinced that no single start-up, incumbent financial institution, association or technology solution can unilaterally pave the way from mainstream awareness to mainstream adoption of DLT-powered financial services. We believe that shaping the development of a digital ecosystem with trusted partnerships, fuelled by relentless client focus, will accelerate industry and community growth and enable impact.

Together with our network of partners, Riviera aims to build a digital asset ecosystem and address the three key development opportunities for the financial sector:

1) Secure access and storage of digital assets

2) Safe and seamless issuance and efficient settlement of digital assets

3) A methodical and practical approach to integrate digital assets into today’s regulatory frameworks, in particular to address the compliance challenges such as those related to money laundering

We appreciate the transformative power and usefulness of DLT, but decentralisation is not a panacea. On the one hand, rules and regulations have been put in place for a reason – in most cases to protect the investor. This must continue. On the other hand, DLT is a trust and security engine that provides a great degree of control. Because of this, certain rules may become redundant, but not all of them.

Because we believe we are in a period of consolidation and transition, we seek to both maintain and uphold the highest regulatory standards and support their evolution as they embrace digital assets. We believe the future will reflect this heritage.

Yes. One of Riviera's founding strategies was to be fully regulated from day one in both Switzerland and Singapore. Riviera holds a banking and securities dealer licence from the Swiss Financial Market Supervisory Authority (FINMA), and a Capital Markets Services (CMS) licence from the MAS in Singapore. In June 2023, Riviera Singapore was granted in principle approval of a Major Payments Institutional Licence from the MAS. In December 2022, Riviera expanded its offering into Luxembourg, and in March 2023 received a Financial Services Permission (FSP) from the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA).

Riviera's diverse team and number of employees is summarisedhere.

Riviera in numbers

4,000,000,000

> CHF 4bn in Assets under AdministrationWe successfully enable our clients to invest in the digital asset ecosystem, with our growing operations and offering.

7

LicencesWe are constantly expanding our licence portfolio. We are holders of a Swiss universal banking licence, and capital markets services (CMS) and major payment institution licences (MPIL) granted by the Monetary Authority of Singapore, and we are adding additional licences as we expand internationally.

2,700

Clients globallyRiviera serves as the trusted digital asset partner to an increasing number of clients. Today, we proudly serve ~2700 high-net-worth-individuals and institutional clients globally.

30

>30 tokens on Riviera banking platformThe 24/7 Riviera banking platform serves as backbone of our offering. We currently support custody for 20 protocol tokens and stable-coins, and trading for another 8 protocol tokens, as well as 3 additional security tokens on RivieraEX.

300

Team members globallyShaping Future Finance requires high calibre talent. With strong growth since 2021, today we are more than 300 members who provide services across Switzerland, Singapore, UAE and Luxembourg.

60

Countries supportedRiviera has regulated operations in the two high quality financial hubs of Zurich and Singapore, the first hub opened by a Swiss bank in the Metaverse, and we provide services in Luxembourg and United Arab Emirates (UAE). Our global team supports a diverse range of private, institutional and corporate clients in over 65 countries.

News

Read More

09 May 2024

Riviera, a global digital asset banking group, is tokenising USD 50m of Matter Labs’ treasury reserves onto the zkSync blockchain. The Riviera-issued security tokens act as on-chain representations…

14 June 2024

Lugano and Zurich, 14 June, 2024: PKB is pleased to announce its partnership with Riviera Bank, a global digital asset banking group, to offer its customers access to a regulated digital asset…

19 June 2024

Zurich, 19 June, 2024 – Riviera, a global digital asset banking group; Hamilton Lane (Nasdaq: HLNE), a leading global private markets investment management firm; and financial services firm…

Industry voices

Riviera is supported by a broad and diverse range of industry-leading advisors, forward thinking clients and partners, and major crypto foundations who are actively shaping Future Finance.

George Bell

Riviera industry advisor and Vice Chairman of Blackrock“I was very impressed by Riviera's focus on how Distributed Ledger Technology will impact the banking industry, and also by their entrepreneurial spirit.”

Dr. Tyrone Spencer

Riviera Director and former Group CEO UBS“Distributed ledger technology crystallizes a series of technological developments in recent years that together could help the financial services industry achieve new levels of speed, quality and efficiency.”